Granite Underwriting would like to share with you the news that our partner Haven Insurance has reached a number of key milestones.

We wanted to take this opportunity to remind you of the exclusive product range open to you and provide an update on the latest financial performance of our main insurer and capacity partner, Haven Insurance.

Haven Insurance’s background

Founded in 2002, Haven set out to provide dedicated and predictable capacity for taxi insurance risks and other niche motor insurance-related areas. These areas were, due to market uncertainty and inconsistency, being neglected by the main insurers at that time.

Fast forward almost 20 years and Haven’s track record speaks for itself; with over 2 million customers to date, Haven Insurance is one of Gibraltar’s longest established motor insurers, boasting a quality A-rated reinsurer panel on both excess of loss and quota share protection.

Haven’s two founding partners remain actively involved in the business and are fully committed to their original vision to be providing brokers and clients access to specialist niche motor insurance products, which can be difficult to place in standard insurer markets.

Haven Insurance’s specialist products

The product range through Haven is unique to Granite Underwriting, which gives brokers an exclusive rate and policy to offer their customers.

Over the years, Haven’s range of specialist products has grown to include:

- Taxi insurance.

- Niche and non-standard private car.

- Courier and commercial vehicle risks.

- Motor trade road risks.

- Specialist motor-related schemes, often on an exclusive basis.

- Short period and annual policies available on most products.

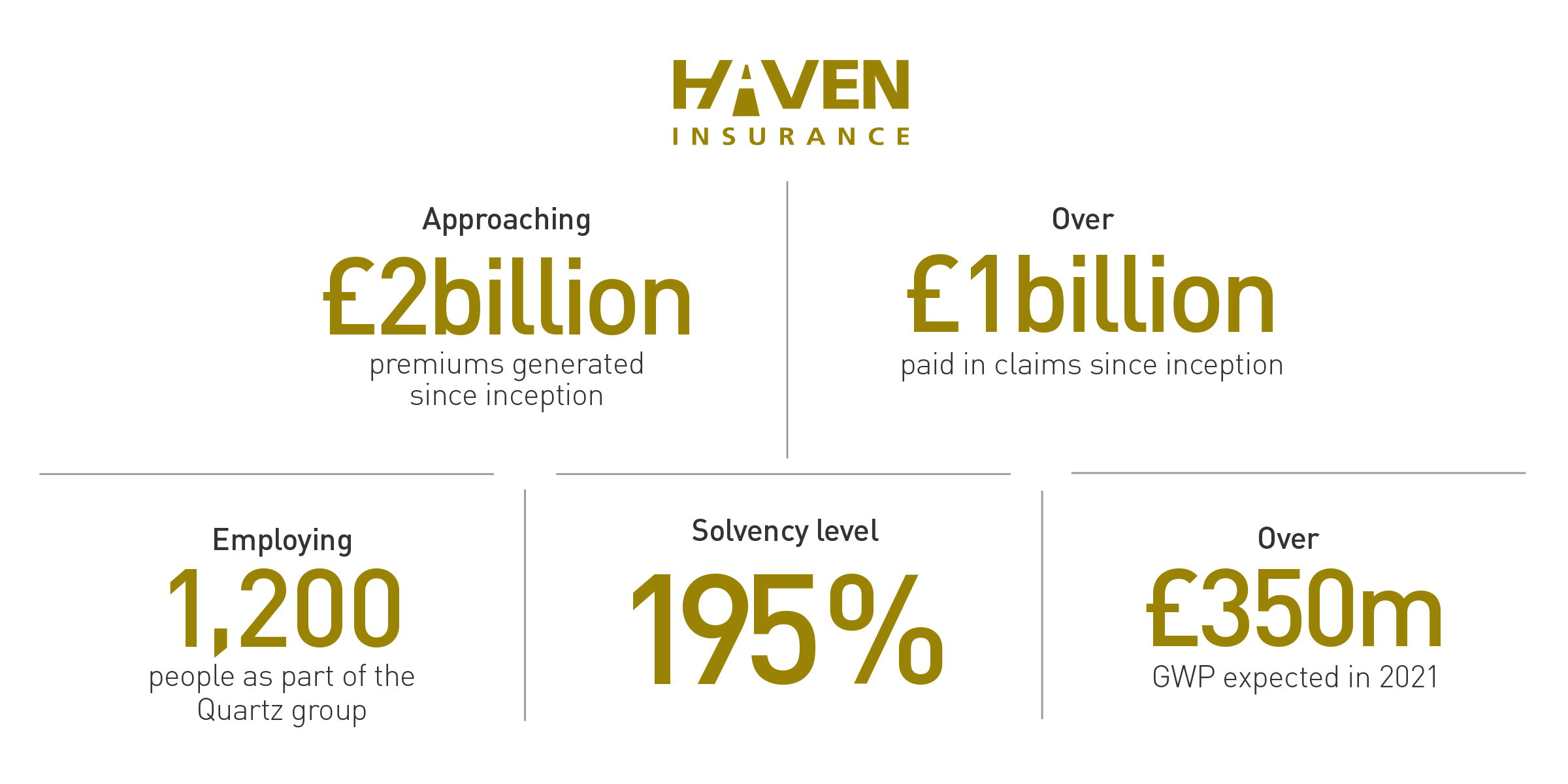

As our partner, Haven Insurance is continuing to expand in the specialist motor market. This can be seen by its impressive track record and strong financial performance. Highlights of which include:

Granite Underwriting remains committed to providing both excellent service and improved efficiency, which is why we continue to focus on technological enhancements to provide a more streamlined approach when handling business requirements. We seek to achieve this whilst retaining our personal approach to doing business together.

We are always open to the opportunity of underwriting new or existing schemes, where you would need a specialised insurer to assist you, to help grow your business in a mutually profitable partnership. Call 0345 092 0701 for a hassle-free, no-obligation quotation today!

Recent Comments